The Beginner's Guide to Project Accounting

Want to become proficient in project accounting, but don’t know where to start? We’ve made this guide for everyone who dreams to forget about budget overruns by adequately analyzing, tracking, and reporting project finances.

Brought to you by Forecast, the leading project, resource & budget management software, this article will not only focus on the project accounting basics and generally accepted principles, but also suggest how to improve the way you work with numbers either on a project-by-project basis or managing a project portfolio.

If you already know what project accounting is, how it’s different from financial accounting, and what role project accounting plays, jump to the last sections, where I describe some of the best practices of project-based accounting and tools to get it right from the beginning.

- What is project accounting?

- Project accounting vs. financial accounting

- The importance of project-based accounting

- The role of the project accountant

- Project accounting tips & best practices

- A checklist of project accounting principles

- Project accounting software tools

What is project accounting?

To get a proper level of certainty that project costs are on track during the project’s lifecycle, businesses leverage project accounting. At the intersection of project management and financial accounting, project accounting is a relatively new, but important skill to pick up. It contributes to a sustainable use of resources in project- and service-oriented companies and helps to keep failures at bay.

The purpose of project accounting is to meet the needs of project delivery, paying special attention to all financial components of a project such as project budgets, cost estimates, expenses, billable and non-billable elements, and everything that falls within the initiation and closure phases. This includes the practice of generating financial reports to follow up on the financial progress of projects. Upper managers use them for better visibility across projects to see if they are delivering value to an organization.

Overall, project accounting covers the following areas of responsibilities:

- Invoicing

- Expenses

- Project control (tracking actuals vs. planned time and money)

- Project financial reporting & analysis

- Management of project assets

- Plus many more, depending on the scope of the project

The difference between project accounting and financial accounting

What is the difference between project accounting and financial accounting, considering that both bring company finances to the table? Speaking of project accounting, you’ll be more interested in the transactions related to a particular project, whereas financial accounting would have a broader stroke on business finances.

A sharp and notable contrast between the two, according to Elizabeth Harrin, is that project accounting has start and end dates that correspond to the days your project should start and finish. While project accounting is tied to the project scope, financial accounting is based on periods in a financial year, that differ from business to business, as they depend on the start day of the company.

When reporting enters the stage, project accountants require numbers that are completely based on deliverables. As in, how much did it cost us to complete this project, milestone, or task? In turn, financial accountants look at different aspects of running a business, like loss and profit. To examine the costs, financial accountants would also follow a different kind of hierarchy than project accountants, looking at the financial performance of departments or cost centers.

The importance of project-based accounting

The importance of project accounting can’t be overemphasized. It has become a core necessity tied to project management when businesses realized that each project is a unique individual entity, usually different from other business activities. General management and financial accounting skills weren’t enough to cover the financial analysis of the project, which led to the appearance of project cost accounting as a unique accounting sphere dedicated solely to projects.

That’s why project accounting is turning into a skill that all project managers need to qualify for today. According to Project Management Institute, the scope of the project manager’s job is expanding. As organizations become more project-oriented, project managers have to be more financially savvy. In addition to completing projects on time and on budget, they are expected to ‘look at projects as ventures’ and monitor how they contribute to the long-term financial success of the business.

As a matter of fact, project-based accounting can contribute various other benefits to the company:

- Documenting incremental, day-to-day revenues, expenses, costs, and profits, project-based accounting is a source of pivotal and immediate information about where the project is earning or burning money.

- Well-organized, project management accounting can enable a holistic oversight of all aspects of the project and showcase if any resources are in demand or not. It can be a go-to for plugging any budget leaks and fine-tuning the financial performance of every project.

The role of the project accountant

While larger companies might have designated project accountants, smaller businesses pass the project accounting job to the project manager.

If not part of the project manager’s responsibility, the job of project accountants is to ensure that projects are planned and managed in agreement with financial contracts, at the same time making sure that all projects are financially viable. It would also be up to the project accountant to do monthly reports on how the project financials progress, forecast the budget and costs, and problem solve based on the numbers they see.

To do so, project accountants need to understand the basics of project management and accounting. They also have to know the ropes of project management methodologies and how all project aspects connect. Project accountants will then collaborate closely with project managers to approve expenses and invoices and communicate over the estimating, forecasting, cost accounting, revenue recognition, and cash flow processes.

Describing one day of project accounting in Lendlease, Gina Hadiutomo recalls:

My day-to-day activities include ensuring costs and revenues are accurately reported for all projects at the end of the month, assisting the business with project set-up, accounting, and system-related queries, and engaging in various project-based analytical initiatives.

It’s also true that when assigned to projects, whoever handles project accounting, they are often expected to play the role of financial gatekeepers and advisors. They are not only responsible for tracking project finances and reporting the results to management, but also explaining to the project team how decisions being made affect the project budget.

Project accounting tips & best practices

1. Focus on resource management first

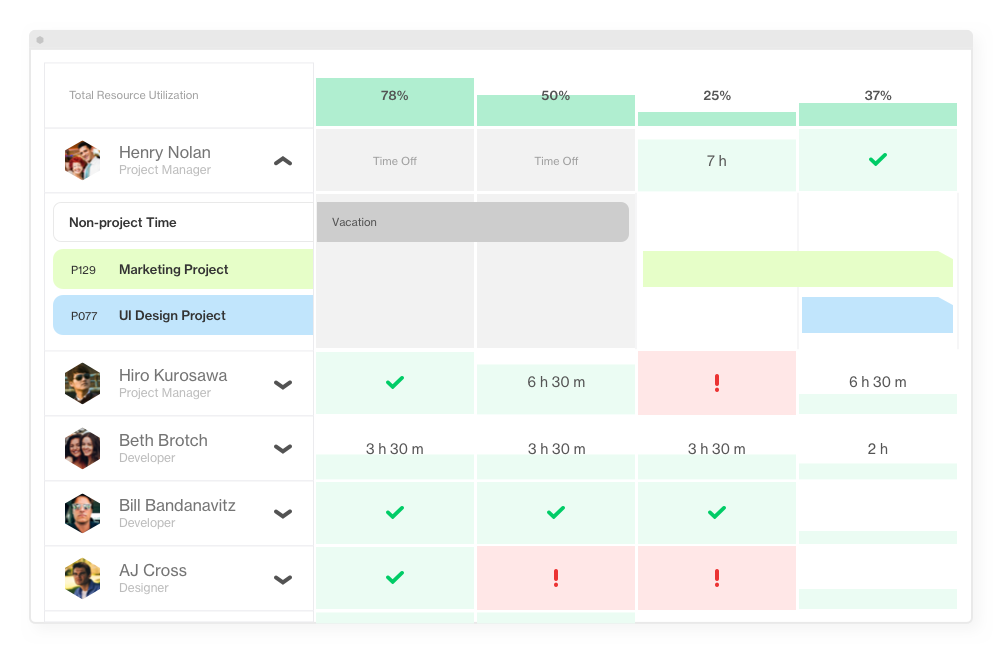

To ace project accounting, the focus of the project manager should be on the full scope of resources. Every project depends heavily on resources, such as time, labor, and material. So you want to be certain of how resources are allocated and what their consumption levels are. At the end of the day, only by tracking resources, you can collect the puzzles and say if the numbers are inside or outside the established perimeter.

It’s important to remember that each resource has a cost assigned to it, and as they add up, you can further understand the actual vs. planned time and cost of the project. To avoid cost overruns, your job is to account for all resources at the beginning. For example, when estimating the budget for materials used, don’t forget that some types of materials have a preliminary cost of purchase, plus ancillary costs, such as delivery, preparation, and installation. When it comes to estimating the cost of labor, things can become even more complicated, as you’ll have to deal with the efforts of everyone involved in the project.

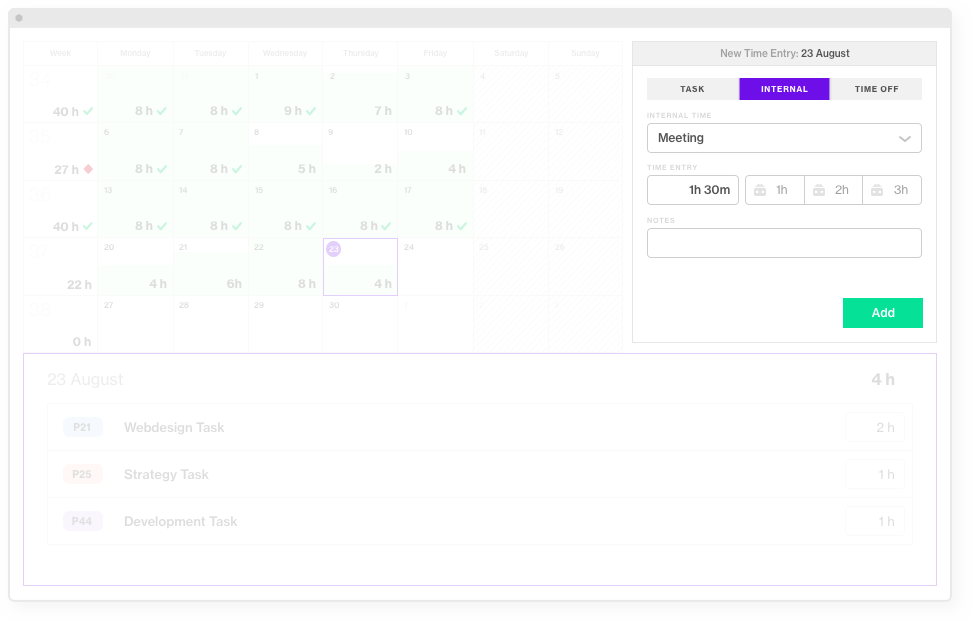

2. Track time

Without having your team register time every day, you’ll have no idea if the project is making headway and won’t be able to calculate real-time cost. To understand how the project is progressing and if it’s hitting the goals set in the planning stage, project managers always need a clear overview of how much time employees are spending on projects. With advanced time management, you can track data as it happens. That’s why timesheets are worth the gold, they make it easy to report on the project’s finances and see what tasks consume the most resources.

In Forecast, time tracking goes hand in hand with the rest of the project and resource management features. Registering time, your teams can see it reflected on the project’s progress, while you can monitor project cost carefully. The only thing you need to set this mechanism in motion is to fill in the rate cards for each role and foster a time registration culture.

3. Don’t let too much administrative work in

Have you heard about the notion of non-billable work? When it hits the project, the budget and resources are consumed without reflecting on the project progress. Meetings, internal activities, etc. can all contribute to it, but what could be even worse is time spent on clerical work, such as filling in spreadsheets. Make sure that non-billable work eats no more than 10% of your time to keep allocated costs on track. Invite automation to your company to achieve more productivity for the same cost.

4. Control change

Most project accountants are often too late to understand that change is happening. The fundamental reason behind is that they come to spot change when it has already made a footprint on the numbers. Having your say in the change control process could fix that and help you stay on top of everything. You have a special power at your fingertips - numerical data, which can convince management to trade changes for other tasks that were estimated to have the same cost.

A checklist of project accounting principles

Now that the basics and theories are out of the way, let’s focus on the most important thing - project accounting methods from a practical standpoint. The rule of thumb is that successful project managers and accountants make sure that projects are delivered against promised budgets. But how? It is only possible with enough level of detail on every stage of the project accounting process flow. In fact, it doesn’t matter whether you’re doing project accounting for construction or software development company, they all have the same stages to pass through.

Initiation

At the initiation phase of the project, project accountants participate in initial budget estimation and cost-based analysis, which means they might be asked the questions that follow below.

- Do you know when to take in new projects?

Based on resource availability, rate cards, company finances, and the progress of other projects, project accountants can present valuable insights as to whether another project fits in the schedule.

- Can you learn from similar project budgets to make an estimate?

Doing the preliminary budget analysis, you’d most likely benefit from insights you have from previous projects you estimated and monitored. If there’s limited information regarding the project, analogous estimation is a workaround.

Overall, the initiation phase of the project gets project managers and accountants to pull all of their past experience together with current company finances and advise upper management as to take in the new project or not, based on relevant financial data and forecasts. On the other side, clients would either have their own fixed budget or ask you to give a rough estimate of how much a project is going to cost.

Planning and setup

The planning phase of the project is all about creating a detailed in-depth schedule and budget plan together with time and cost estimates. Go through the following list of questions to see what is expected from a project accounting pro.

- Does your project have a realistic start and end date?

To scope the project, project managers and project accountants should work together, having time, costs, and resources all work in harmony. But how does one make sure that all estimates are accurate and milestones feasible? Forecast’s AI already helps to solve this kind of problem, by learning from past projects and making credible suggestions.

While you may think that a project start date might not be the issue, only having a clear understanding of your capacity and a portfolio view, a project manager decides on when resources should start working.

- Does every deliverable have an assigned cost?

A project budget is calculated based on the combined costs of all activities, tasks, and milestones. For it to be accurate and precise, every deliverable or expected output should be assigned a cost.

- Is there a budget contingency reserve?

There are many reasons why projects run over budget, but often they just don’t account for all the risks. While the AI may cover task estimates and the hours of labor, Forecast also gives you an opportunity to add a markup percent to provide a cushion against surprises, like supply prices increase. Consider adding 10% on top of the calculated budget to cover the additional costs that might pop up.

- Do you have a source of data to rely on?

Project scope, Task list, Statement of Work, or Schedule are all good sources to rely on when estimating a project budget and then tracking it against the initial plan.

During the planning and setup project phase, it’s essential to pay special attention to how you assign costs and plan your budget. Take a close look at your past projects to see if it’s possible to detect the causes of cost slippages.

Execution

The importance of the execution phase can’t be overemphasized. In fact, for project accountants, it’s the most responsible period, where their skills come in especially handy to maintain the financial health of the project and monitor its profitability.

- Are you tracking spend against planned costs and milestones?

Knowing if the costs are spent and burned down according to the plan is a must for project accountants who want to keep budgets on track. However, it might be difficult without the right platform in place. The right project cost accounting system ties all project activities with time registrations and associated costs to show you the financial picture of all projects you need to monitor.

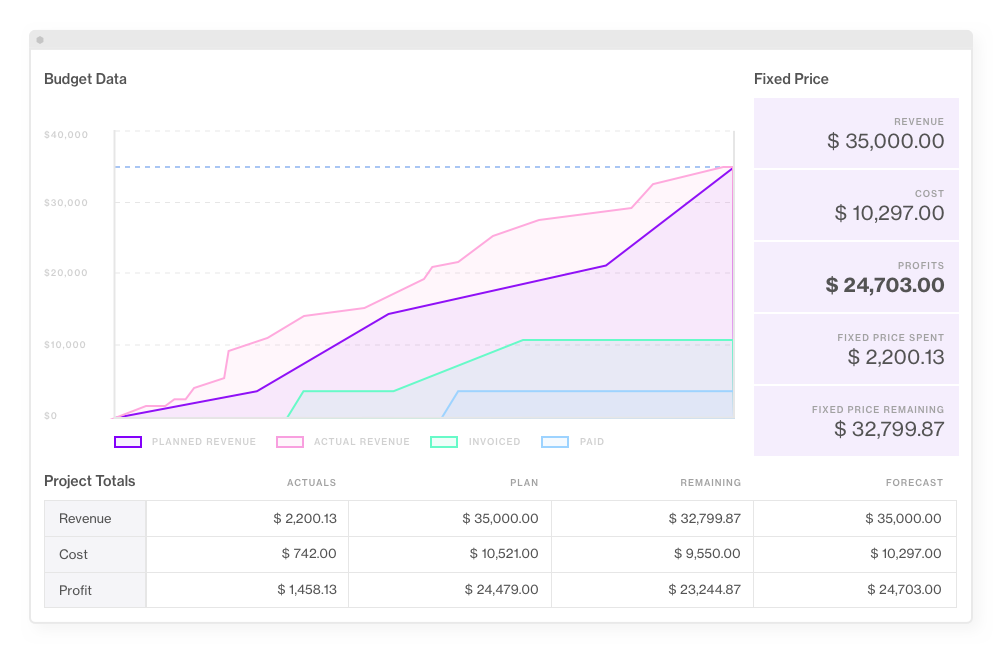

- Are you able to track revenue, cost, and profit on each project?

Keeping everything in one platform is extremely important for project managers and accountants in the first place. Having a single source of truth for all project financials saves time for many critical tasks, like data management and strategic advising. Instead of spending time gathering bits and pieces, you focus more on strategic objectives. One might benefit from a robust solution like Forecast, that connects every piece of project data to automatically generate a Financial Portfolio Report, full of insights to immediately act on and pass to management.

- Do you understand the level of profitability of each project?

Understanding the financial aspect of the project well means clearly seeing figures you can compare. Looking at Planned vs. Actual cost, profit, and revenue, gives project managers and accountants the true picture of the project’s progress. Additionally, out of all the numbers you have in front of you, you might want to track the profit margin. The profit margin varies drastically across the industries. While the airline industry may have a margin of about 5 percent, the software development sector can have about 90 percent.

When the execution phase begins, teams start to work on project tasks and the costs are subtracted. At this point, project managers start to see the difference between what they planned and how work progresses, and start to report the health of the budget to stakeholders. If not monitored, most of the budgets slip during the execution phase. For budget overruns to stop happening in project-based companies, it’s important to see where teams register their time.

Scope creep

Although not a stage recognized in theory, scope creep is often what happens to projects that were poorly planned, tracked, or had changed along with the execution phase. According to Project Management Institue’s Pulse of the Profession survey carried out in 2018, 52% of projects experience scope creep. It concerns even PMI's top performers, as 33% of their projects also end up in some form of scope creep. When projects enter this stage, project accountants would benefit from active numbers that don’t lie.

- Can you access numbers on the fly?

Unfortunately, the problem many companies are still dealing with is static numbers. In other words, project accountants lack a real-time view of project finances and can’t track how data changes in the course of time. What if you always had access to active lists of financial project data that would change accordingly? Take a sneak peek to see how you could benefit from one here.

- Can you see if the teams aren't burning more money than expected?

In Forecast, we encourage teams to register time honestly on the tasks and projects assigned to them. If anyone starts to register too much time, project experts get a small warning. Who knows, this could be a sign that the budget is starting to slip.

- Can you see what role or milestone is dragging project costs down?

Seeing that the actuals are different from planned, one might need to run a little investigation and unmount to what happens at the task level. Your project management accounting software probably has a feature that automatically relates if something is costing more than expected. If it doesn’t, check Forecast’s project budget solution. It provides you with insights showing for which milestone or role you spent more than planned.

Setting a clearly defined scope, seeing the big picture, and being able to break down all the numbers real-time, helps project managers avoid unexpected scope creep. If your project finances experienced scope creep, no worries. Here’s how to plan your way out.

Closure

During the last phase of the project lifecycle, a project manager involved in the financial analysis will be expected to hand over the reports to management. Management will most likely be interested in the revenue, cost, profit, and margin to see how the project has affected the company and its financial picture. Every project teaches a lesson. This time, did you manage to account for all the risks? Did your project accounting pass the test?

Project accounting software tools

If you want to zip through the above stages smoothly, a project accounting system is a must-have, mainly because it saves time you’d spend digging the numbers.

To plan and manage projects from start to finish, we’ve developed a platform powered by AI that links every project activity with the associated cost and generates a budget that provides valuable insights on the project’s health in real time. With Forecast, you have all the numbers you need at your fingertips and can keep all your projects and finances connected in one system. Continue reading below how Forecast helps you keep budgets on track or start a free trial to become a real pro in project accounting.

Subscribe to the Forecast Newsletter

Get a monthly roundup of productivity tips & hacks delivered straight to your inbox